A Beginner's Guide to Understanding Bitcoin Mining

Curious about how Bitcoin mining works? Here's a quick overview.

What’s a Rich Text element? What’s a Rich Text element? What’s a Rich Text element?

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

What’s a Rich Text element? What’s a Rich Text element? What’s a Rich Text element?

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

What’s a Rich Text element?

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

What’s a Rich Text element?

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

What’s a Rich Text element?

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

What’s a Rich Text element?

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

- Headings

- Paragraphs

- Blockquotes

- Headings

- Paragraphs

- Blockquotes

This article will be explaining, arguably the most intricate aspect of Bitcoin.

What is Bitcoin Mining?

Bitcoin is a decentralized cryptocurrency. Unlike transactions of fiat money, which are controlled by a central entity, like a bank. Bitcoin does not allow a central entity to conduct transactions. Transferring money with a central entity is easy. Simply inform the bank that you want to remove a desired amount of money and transfer it to a separate account. In this case, the central entity has got all the power. As it is the only body that has the authority to update a ledger, which possesses the balances of every stakeholder present in the system.

So, how does one create a similar system with a decentralized approach?

How do we give an entity the power to update the ledger, without giving them authority to corrupt the system? The order of rules for Bitcoin, known as ‘the protocol’, solves these tasks, uniquely. This process is popularly referred to as ‘Who wants to be a banker?’ At its essence, this process allows anyone who wants to participate in updating the ledger of Bitcoin transactions, known as the blockchain, the authority to do so. All one needs to do to be a banker in the bitcoin system is guess a random number that solves an equation generated by the system. Needless to say, the guessing is processed by a computer. The power of the computer and the number of guesses made per second are directly proportional.

Thus, the more powerful a computer one has, the higher the chances of winning will be. If one guesses right, they earn Bitcoins and are also rewarded by the opportunity to get to write ‘the next page’ of Bitcoin transactions, on the blockchain. To explain it simply – Once a mining computer guesses right, the mining program for that computer determines which of the current pending transactions will be assembled into the next block of transactions.

Compiling this block, showcases the moment of triumph for the proprietor of the computer, as they now have become the temporary banker of Bitcoin. This gives them the ability to update the Bitcoin transaction ledger, known as the blockchain. The block created along with the solution, then sent to the whole network, so other computers can verify it. Each computer that validates your solution, update their copy of the Bitcoin transaction ledger, with the transactions that the computer chose to include in the next block. We interpret from this, that mining is a guessing game. Hence, for each block, a different miner will guess the number and will be granted the right to update the blockchain accordingly.

As stated before, the miners with more computing power will succeed more often. But due to the laws of statistical probability, it is preposterous that the same miner will do so every time. After this phase, the system generated a fixed number of Bitcoins and rewards them to the proprietor of the computer, as a reward for the time and energy they spent in solving the mathematical problem. Additionally, they get paid the transactions fees, that were attached to the transactions they inserted into this block. This is Bitcoin mining in a nutshell. This process is called ‘mining’ because it helps ‘mine’ new Bitcoins from the system.

But practically, the mining part of this process is a result of the transaction verification process. So, the name is a bit confusing, as the main goal of mining is to maintain the ledger in a decentralized manner. Now that you have comprehended what Bitcoin mining is, do not hurry out to the races, it is not this subtle. Satoshi Nakamoto, the inventor of Bitcoin, crafted the mining rules owing to the principle of more the mining power the network has, the harder it is to guess the answer to the mining mathematical problem.

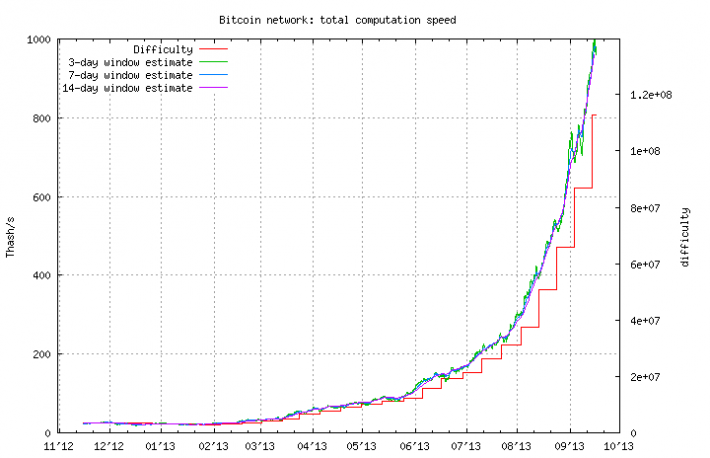

Thus, the difficulty of the mining process is indeed self-adjusting to the collected mining power the network possesses. If more miners mine, it will get harder to solve the problem; If several of them leave, it will get easier. And this is the mining difficulty. Satoshi did this to create a steady flow of new Bitcoins to the system.’ Simply this was done for steady inflation. The mining difficulty is set up, so on average, a new block will be added every 10 minutes. Since this is average, the number of blocks per minute can vary, but in the end, this evens out to 10 minutes on average. The sort of self-adjusting mechanism created a very competitive environment. To get the most efficient and powerful miners, in the shortest period.

When Bitcoin was created, there was a handful of people mining, with their personal computer (PC) too. Using a single PC’s central-processing unit, i.e., the brain of the computer, was enough for mining in 2009, since the mining difficulty was low. As Bitcoin grew, so did the devices, people moved from CPU mining to GPU mining. A graphic-processing unit ‘is a special component added to computers to carry out more complex calculations.

GPUs were initially created to allow video games requiring high graphics, to run efficiently on a computer. Because of their architectonics, they became popular in the field of cryptography, and finally around 2011, folks started using them to mine Bitcoins. For better understanding, the mining power of one GPU is equal to that of approximately 30 CPUs. After GPU, field-programmable gate array (FPGA) became vogue for mining. FPGA is a piece of hardware that can be connected to a computer to conduct a set of calculations. They are like GPUs, only 3 to 100 times faster. But they are harder to configure, hence GPUs are a lot common. Around 2013 a new sort of miner was introduced – the Application-Specific Integrated Circuit (ASIC) miner.

These were hardware created solely for mining Bitcoin. Contrary to its predecessors, it could not be used for any other function. Their function was hardcoded into the machines. ASIC miners are the current mining standard. When one starts to mine, even with the greatest miners, they are off great disadvantages, because of mining farms.

Mining farms are places of work, where several potent miners are hired and given a certain salary to mine for that specific farm.

To defeat this disadvantage, miners came together to form a ‘pool’. This means, that they combine their mining power to compete more productively. If a pool wins the competition, the reward is evenly distributed, depending on the amount of mining power each of them contributed. This process allows small miners to earn Bitcoins too. There are a lot of mining pools present in the contemporary world.

Okay, so this all sounds good in the thesis, but is mining profitable? The short answer is probably not. The long (and correct) answer is it depends on a lot of elements. When determining Bitcoin mining profitability, there are several factors one needs to take into consideration:

⦁ Hash rate: A Hash is a mathematical problem the miner’s computer needs to solve. The Hash rate refers to the miner’s performance, or the number of guesses the computer can make per second. Hash rate is measured in Mega Hash per second (MH/s), Giga Hash per second (GH/s), Terra Hash per second (TH/s) and Peta Have per second (PH/s).

⦁ Block reward: This represents the number of Bitcoins produced when a miner finds the solution. Initially, in 2009, this number started at 50 Bitcoins. It gets divided by 2 every 210, 000 blocks, i.e., about four years. The current number of Bitcoins awarded per block is 6.25.

⦁ Mining difficulty: This is a number that denotes, the difficulty of mine Bitcoins, at a certain moment, according to the amount of mining power currently active in the system.

⦁ Electricity cost: This is peculiar. This is the amount of money one pays for their electricity bills. The number of INR (any other fiat currency) is one paying per Kilowatt. One needs to find out the electricity rate to calculate profitability. The reason this is an important element is that miners consume electricity, whether for powering up the miner or for cooling it down.

⦁ Power consumption: Each miner consumes a different amount of energy. One needs to figure out the exact power consumption of their miner, before calculating profitability. This can be easily found on the internet. Power consumption is measured in Watts.

⦁ Pool fees: If one is mining through a mining pool, as one should, then the pool will collect a certain percentage of the earnings for rendering their service.

⦁ Bitcoin’s price: Not me, not you, not Marco Streng, no one knows what Bitcoin’s price will be in the future. Thus, it is hard to predict if Bitcoin mining will be profitable. If one is planning to convert their mined Bitcoins in the future to any other currency. This variable will have a significant impact on profitability.

⦁ Difficulty increase: This is arguably the most essential and elusive variable. The idea is that since no one can predict, the rate of miners joining the network, neither can anyone predict how difficult it will be to mine in a week, a month or a year from today. As a matter of fact, in all the time Bitcoin has existed profitability has dropped only a handful of times, even at times when the price was relatively low.

The last two elements are the reason why no one will answer the question – ‘is Bitcoin mining profitable?”

After all, these variables are in one’s mind. They can insert them into a Bitcoin mining calculator. This allows one to get an estimate of how much Bitcoin one will earn each month. If one is unable to get positive results on the calculator, certainly, they are not equipped with the right conditions for mining to profitable. At this stage, you must have figured out if mining is for you or not. There are certain unconventional ways of mining too – Cloud mining, Mobile mining, and Web Mining. Cloud mining means one does not physically acquire mining equipment, but rather rent computing power from a mining company, and get paid in according to how much mining power you own. Right off the bat, this seems like a good deal. One does need to buy expensive equipment, storing it, cooling it, and monitoring it. However, the calculation tells us that, none of these cloud mining sites is profitable. Those that do seem profitable, are in most cases scams. Word of the wise – avoid Cloud mining. And if you are adamant to do so, think a hundred times, before sending any funds.

Few mobile apps claim to mine Bitcoin on one’s phone. While in theory, it is possible, due to extremely weak processing power phones have compared to ASIC miners, one is bound to end up draining the battery of the phone, at a much faster pace. Thus, in doing so, one is making a very small fraction of a Bitcoin in return. The apps that allow this, are in essence, taking the role of mining pools for mobile phones, and distribute earnings per the work done by each phone. Do keep in mind, that mining is possible on an old computer, it is just not practical enough, because of the electricity wasted on it. Since the slower the computer, the smaller the chances of getting a reward. In 2017, web mining was introduced.

Simply, web mining allows website operators to ‘hijack’, their visitors’ CPU and use them to mine Bitcoin. This means that a website operator can use thousands of ‘innocent’ CPUs to gain profits. However, as CPU is not very viable for Bitcoin mining, web mining sites use their visitors’ CPUs to mine other cryptocurrency coins instead. The concept of web mining is extremely contentious. From the perspective of the visitor, someone is using their computer without consent to mine Bitcoins. In extreme cases, this can also harm the CPU due to overheating. From the perspective of the owner, web mining has become a new way to monetize websites, without annoying advertisements. Also, the site owner can control how much of the visitor’s CPU they want to control, to confirm they are not abusing their hardware.

Is mining a waste of electricity?

There has been a lot of criticism regarding the energy consumption, by mining workers. Various arguments do not withhold this case. One could argue that Bitcoin ultimately requires fewer resources, than the current banking system. If one takes into account banks, servers, ATMs, card companies, and all other factors of the current monetary system, one will conclude that it is much more wasteful than Bitcoin mining. Especially if one considers all the paper and pollution involved. One could also say Bitcoin mining, is optimizing power consumption globally. as many companies are moving their mining operations to countries that have an excess of electricity.